Unleashing the Power of Data: The API Economy and Open Banking

Exploring the immense potential of data-driven innovation within the financial services industry.

This article will go thoroughly into embedded insurance, examining the concept, methods, market drivers, practical applications, advantages, challenges, the role of InsurTech, future trends, and the importance of working in sync with an experienced supplier for its development.

In 2022, the embedded insurance market was valued at $56,979.8 million and is continuing to experience tremendous growth and transformation. This market’s rapid development in the insurance sector, as insurers avoid conventional methods to adapt to changing consumer demands in a society that prioritizes digital technology.

The concept of embedded insurance, which is quickly gaining acknowledgment in the insurance industry, marks a significant change in how we perceive and approach insurance. Embedded insurance’s fundamental goal is to seamlessly include insurance products into many aspects of daily life, offering protection just when it is most necessary and relevant.

Imagine yourself making a flight reservation for an upcoming vacation. With embedded insurance, you can buy comprehensive travel insurance and choose your flight and accommodation throughout the booking process. This perfectly illustrates how embedded insurance works since it integrates insurance into regular transactions.

The importance of embedded insurance is found in its ability to improve client satisfaction by removing the obstacles and complications involved in conventional insurance transactions. Insurance shifts from reactive to proactive, recognizing and resolving issues before they become more serious. Additionally, it promotes loyalty and trust because customers see insurers as partners in their daily lives rather than as impersonal corporations that should only be addressed in an emergency.

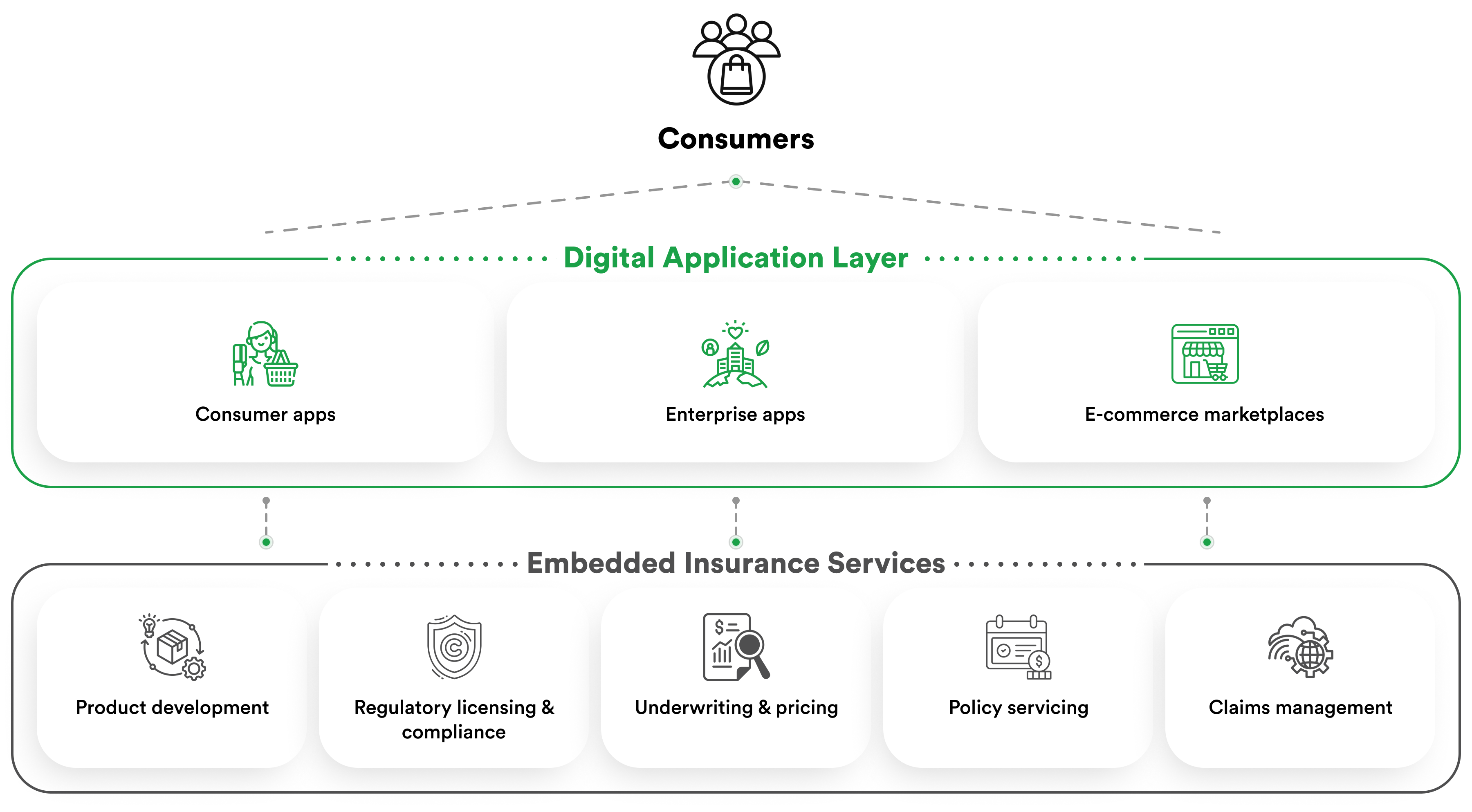

To smoothly incorporate insurance services into multiple client journeys, embedded insurance makes use of technology, particularly Application Programming Interfaces (APIs), cloud solutions, and Artificial Intelligence (AI)/Machine Learning (ML). This technologically driven strategy ensures that insurance is provided smoothly and without disruption.

Embedded insurance ideally satisfies the rising demand for convenience, customization, and efficiency as the world becomes more digital. It meets the needs of today’s consumers, who anticipate on-demand service delivery and customization to suit their interests and way of life.

Understanding the revolutionary potential of this new insurance concept requires distinguishing embedded insurance from conventional insurance products. The seamless integration of embedded insurance into client touchpoints and digital ecosystems makes it necessary for daily business. It provides coverage exactly when needed, personalizing coverage based on context and data.

Contrarily, typical insurance operates in isolation and frequently requires clients to start independent policies through a more reactive procedure. While traditional insurance may include drawn-out application procedures and limited customization, embedded insurance stresses frictionless user experience and offers straightforward, apparent coverage alternatives. In the end, embedded insurance represents a change toward proactive, context-aware, and personalized solutions, defying established insurance norms in the digital era.

This innovative insurance approach’s fundamental component incorporates embedded insurance into user journeys. It centers on seamlessly integrating insurance alternatives at multiple client touchpoints and digital interfaces. This ensures that insurance blends naturally and appropriately into the user’s experience. By removing friction from the process, embedded insurance enables customers to explore and choose coverage without going through separate insurance channels.

It frequently uses AI and real-time data analysis for quick risk assessment, quickly providing users with customized solutions. The whole user journey is improved by transparency, user education, customization, availability across several channels, and even expedited claims processing. As embedded insurance continues to evolve with advancing technology, it promises to make insurance more accessible and user-friendly than ever before.

Technology plays a crucial part in embedded insurance and is the force behind its innovation and efficiency. Below, we provide more details about the many technology components that make embedded insurance successful.

Embedded insurance is changing significantly, moving away from traditional insurance models and toward a customer-centric strategy. This change strongly emphasizes user empowerment, customization, convenience, proactivity, transparency, and user feedback. It catalyzes innovation in the insurance sector, redefining the landscape by offering individualized, practical, and proactive solutions that complement personal and professional requirements, thereby enhancing client engagement and happiness.

In the embedded insurance model, data analytics is crucial in personalized insurance. It enables insurers to use various data sources, carries out precise risk assessments in real-time, and cater coverage to specific policyholders. This technology ensures fair prices, improves fraud detection, and offers valuable customer insights. Claims processing is streamlined thanks to data analytics, which encourages ongoing innovation in insurance products and guarantees legal compliance. Data analytics, a pillar of the personalized insurance experience, enables insurers to offer plans that perfectly match client requirements, establishing new benchmarks for the industry’s responsiveness and customization.

The insurance sector is evolving even more due to the partnership between InsurTech startups and traditional insurers, which brings unprecedented innovation and dynamism. Through this relationship, traditional insurers will be assisted in modernizing, improving user experiences, and remaining competitive in the digital era by the tech-savvy agility of InsurTechs.

InsurTechs bring innovative, cutting-edge answers to time-honored insurance problems, fostering efficacy and efficiency. With a focus on the consumer, InsurTechs fit very well with the industry’s transition to customer-focused experiences, boosting client happiness and loyalty. Product development and market launch are sped up by collaboration, which takes advantage of established distribution and regulatory compliance know-how.

Advanced risk assessment technologies help traditional insurers improve their underwriting and risk management, while InsurTechs’ proficiency with data analytics enables customized insurance solutions. This alliance also enhances operational efficiency, diversity, and digital transformation, preparing the sector to meet changing consumer demands and legal obligations.

Embedded insurance is a transformative concept reshaping how insurance is offered and accessed across diverse industries. Let’s explore real-world examples of embedded insurance in action to understand its practical applications better.

Product Insurance. At the checkout stage, e-commerce platforms frequently include incorporated product insurance or extended warranties. For example, customers may purchase insurance protection when buying a smartphone online to guard against theft or unintentional damage.

Purchase Protection. E-commerce websites also incorporate insurance options to offer customers purchase protection. This can include coverage for goods that are defective or don’t live up to expectations in terms of quality.

Trip insurance. When making a hotel or flight reservation, many travel-related websites and applications have a trip insurance option. Travelers can easily buy insurance to cover trip cancellations, foreign medical problems, or lost luggage, improving their trip and giving them more peace of mind.

Life Insurance with Investment Plans. When clients construct investment or savings plans, specific financial systems automatically include life insurance. These insurance policies may be coupled with financial products to guarantee that beneficiaries receive a certain sum in the event of the policyholder’s passing.

Temporary Coverage. Ridesharing and car rental businesses frequently provide temporary insurance coverage for users using the vehicle. Both liability insurance and coverage for actual physical damage to the vehicle may be included in this policy.

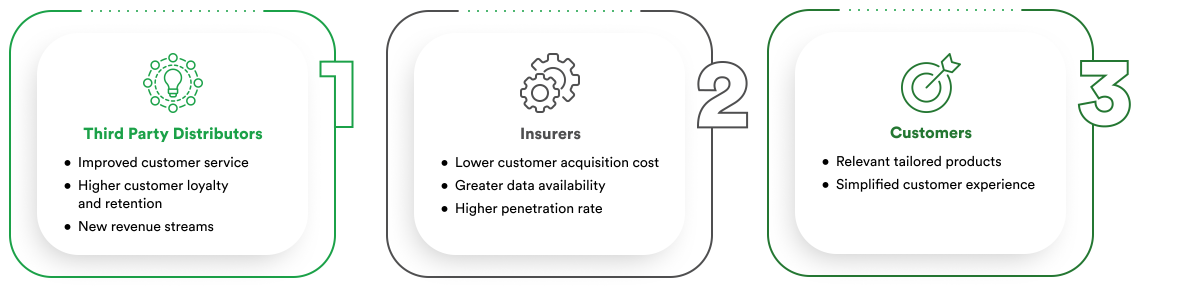

Not only is embedded insurance changing the insurance industry, but it also impacts how individuals and companies see risk. These benefits are available to consumers and businesses that provide these perfectly integrated insurance products.

Convenience of Instant Coverage. The ease with which embedded insurance provides clients with coverage is one of its main benefits. Policyholders can easily access coverage at the time of need rather than through complicated insurance procedures. Embedded insurance guarantees quick and straightforward access to protection, whether to secure a gig work assignment, cover a trip, or insuring a new purchase.

Personalized Insurance Options. Embedded insurance meets the requirements of each client. Customers can tailor their coverage to meet particular needs. With this degree of personalization, policyholders can only pay for the required insurance, disregarding the need for universal plans and potential over insurance.

Potential Cost Savings. Consumers frequently experience cost savings from customized insurance policies. Customers can cut costs by purchasing insurance that properly fits their risk profile. Some embedded insurance services might also be more reasonably priced because of partnerships and reduced procedures.

Enhanced User Experience. Embedded insurance helps make users’ experiences better. Difficulty in purchasing is decreased by smoothly integrating insurance into current transactions or activities. Customers are happier because they are no longer required to leave a platform or fill out lengthy papers to obtain coverage.

A sense of trust. Embedded insurance gives customers trust. Knowing that insurance is in place provides security and assurance, whether protecting a pricey purchase, guaranteeing medical coverage when traveling, or defending against unforeseen mishaps in the gig economy.

Additional Revenue Streams. Embedded insurance offers organizations the chance to diversify their sources of income. Companies can increase revenue while fostering client loyalty by including insurance as a component of their goods or services.

Enhanced user experience. A seamless and user-friendly insurance experience can significantly improve the overall user experience of a business. Increased client retention, favorable ratings, and word-of-mouth recommendations may result.

Reduced Difficulty in the Purchase Process. Embedded insurance makes it less complicated for customers to complete transactions by reducing the friction in the purchase process. Higher conversion rates may arise from this, particularly for companies operating in marketplaces with intense competition.

Data-Driven Insights. Companies can use data from embedded insurance transactions to learn more about the preferences and behavior of their customers. Initiatives for customer interaction, product development, and marketing can all benefit from this data.

Risk management. Businesses can use embedded insurance to help control their goods or services risks. For instance, an electronic equipment manufacturer may provide product insurance to lessen the financial burden of warranty claims or returns.

Competitive Advantage. Businesses that provide embedded insurance may have an advantage over market rivals. The ease of insurance bundles can be a strong selling feature that draws in and keeps clients.

Opportunities for Partnership. To offer embedded insurance solutions, businesses might consider forming partnerships with insurers and InsurTech companies. These collaborations may provide access to cutting-edge knowledge and resources that improve the entire value proposition.

As embedded insurance continues to catch on as a game-changing idea, it is crucial to negotiate the conditions with a thorough grasp of the challenges and issues it raises. While integrated insurance has several advantages and opportunities, it also raises challenging problems that require careful thought.

The adoption and effective implementation of embedded insurance solutions depend on an understanding of and response to these issues, ensuring that they live up to their promise of providing value to customers and businesses while upholding moral and legal standards.

Understanding the complex regulatory environment is one of the most significant difficulties in embedded insurance. Insurance is a highly regulated industry, and ensuring compliance with various requirements in various sectors or areas can be challenging. Companies that provide embedded insurance must collaborate closely with regulators to guarantee openness, customer protection, and compliance with the law. It’s critical to strike the correct balance between innovation and compliance.

When integrating insurance into different platforms, private financial and personal information is frequently exchanged. In embedded insurance, data security and privacy are of utmost importance. To protect client information, businesses must make significant investments in cybersecurity. To preserve trust and prevent legal ramifications, they must also assure compliance with data protection laws like GDPR in Europe or HIPAA in the healthcare industry.

To avoid misunderstandings, embedded insurance should be explained to customers in plain language. This will help them comprehend the terms and restrictions of their coverage. It is crucial to ensure that policyholders know what they are acquiring. Conflicts, client unhappiness, and significant reputational damage for the insurance provider and the platform supplying the insurance can result from ambiguities or a lack of transparency.

Technical difficulties arise when integrating insurance into various systems and user experiences. To guarantee a seamless user experience, platform developers and insurance companies must work together. Developing and adopting embedded insurance solutions can be hampered by technical problems or disruptions in the integration process.

Embedded insurance creates ethical issues, especially about data consumption and the potential for customized pricing based on user behavior. The complex ethical challenge of striking a balance between fairness and personalization is one that insurers and platform providers must openly confront.

The collaboration between established insurers and InsurTech startups is changing the insurance environment as we know it. These dynamic companies are bringing about transformational changes that increase the effectiveness of insurance products but also expand the accessibility of insurance across multiple industries. They are armed with cutting-edge technology and novel techniques.

InsurTech companies are fueling the embedded insurance revolution by forming alliances, breaking ground on novel ideas, and updating outdated insurance structures, making it an appealing option for customers and businesses.

Startups in the InsurTech space are essential for fostering innovation in embedded insurance. These innovative, tech-driven businesses are at the forefront of creating ground-breaking solutions that make integrating insurance simple and effective. Artificial intelligence (AI), machine learning, and data analytics are examples of cutting-edge technology InsurTechs deploys to provide real-time risk assessment, price optimization, and customized insurance offers.Several InsurTech companies are revolutionizing the embedded insurance industry and should be recognized for their efforts.

For example, Sure is a startup that provides embedded insurance infrastructure. Companies can sell insurance directly to consumers “in milliseconds” through an entirely digital experience that does not involve paper or humans.

Zego specializes in commercial motor insurance and offers a variety of coverage choices, such as annual policies and flexible pay-as-you-go insurance. The first new product, tailored towards electric and traditional moped fleets, is usage-based, meaning businesses only pay for insurance when needed.

With user-friendly technology, reasonable prices, and first-rate customer service, Kin Insurance, which operates as a licensed insurance company, is redefining home insurance. By leveraging thousands of publicly available data points, Kin can recommend the appropriate coverage at affordable prices for homeowners.

Marshmallow is a digital-only car insurance provider that has made a name for itself by providing a new approach to car insurance that uses a broader set of data points and clever algorithms to net a more diverse group of customers and provide more competitive rates.

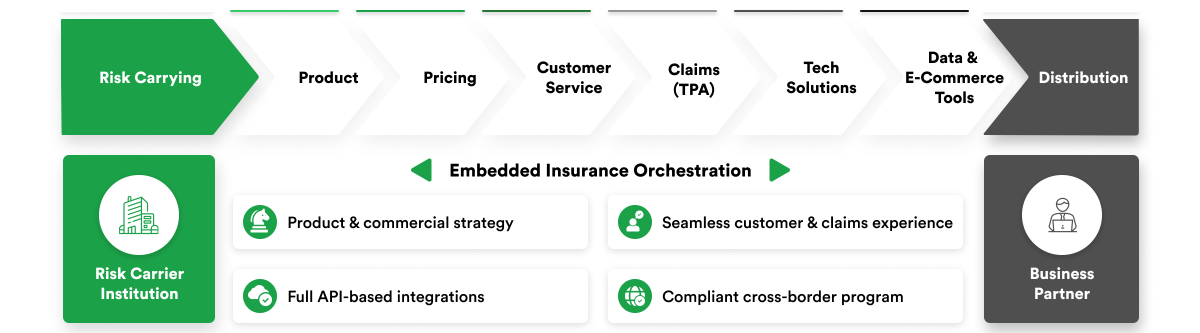

InsurTechs are experienced at building partnerships and integrating their products into various ecosystems and platforms. Effective collaboration is essential for introducing embedded insurance to a variety of sectors. To effortlessly incorporate insurance into their customer journeys, these firms collaborate with platform providers, e-commerce platforms, travel agencies, and other organizations.

Additionally, they make it easier for insurance APIs to be technically integrated, ensuring that the insurance component is seamlessly integrated with the platform’s existing infrastructure. InsurTechs frequently supply pre-made software solutions that are simple to integrate, cutting down on platform providers’ development time and expenses. Additionally, they help established insurers modernize their business practices to be more sensitive to shifting customer expectations and can successfully adopt embedded insurance in various industries.

The way consumers access and engage with insurance products is being transformed by embedded insurance, which is at the forefront of industry innovation. Several new trends that are on the horizon have the potential to change the embedded insurance environment completely.

The development of peer-to-peer embedded insurance models is a significant trend that is on the horizon. This novel strategy enables people or communities to share and manage insurance risks. Decentralized, community-driven systems where policyholders work together to pool resources and jointly underwrite risks may eventually replace traditional insurance structures. This change not only makes insurance more democratic but also promotes a sense of community and help from one another.

Within the integrated insurance framework, personalized insurance offers are about to undergo a revolution thanks to the quick development of artificial intelligence (AI). Insurers can create highly customized policies for specific policyholders using AI algorithms powered by massive data sources and machine learning capabilities. Based on real-time data analysis, these offers will continuously adapt and change to consider aspects like lifestyle, habit, and risk profiles.

Potential impacts on the more significant insurance sector: Adopting embedded insurance and developing these cutting-edge trends significantly impact the more substantial insurance sector. A more dynamic environment is a challenge for traditional insurers. They must invest in technology, data analytics, and cooperative relationships with InsurTechs to stay competitive. The move toward tailored products and decentralized peer-to-peer models challenges the traditional one-size-fits-all insurance approach.

Organizations in various industries are given considerable potential by the development of embedded insurance. Companies may diversify their revenue sources and increase consumer loyalty by effortlessly incorporating insurance solutions into their goods and services. Embedded insurance can be used by e-commerce, travel, financial services, and gig economy companies to improve user experience, lessen friction throughout the purchasing process, and streamline customer encounters.

The insurance sector is about to transform due to embedded insurance, becoming more individualized, customer-focused, and integrated into our daily lives.

Businesses should partner up with trustworthy technology providers with excellent embedded software engineering capabilities to realize the full potential of embedded insurance. As time passes, embedded insurance’s revolutionary nature promises to give everyone a more seamless and personalized insurance experience.

Exploring the immense potential of data-driven innovation within the financial services industry.

A comprehensive overview of how fintech innovations drive significant changes in the retail industry.

Examining AI’s diverse effects on finance, delving into its advantages and obstacles, aiming to understand its transformative influence and future impact on the sector.

Copyright © 2023 rinf.tech. All Rights Reserved.

Terms & Conditions. Cookie Policy. Privacy Policy.

Politica Avertizari de Integritate (RO)