Unleashing the Power of Data: The API Economy and Open Banking

Exploring the immense potential of data-driven innovation within the financial services industry.

Despite their reputation for strength and reliability, these legacy systems are increasingly being recognized for their limitations, such as inflexibility, difficulty in scaling, and challenges in integrating with modern digital technologies. A study by Deloitte found that more than 70% of bank executives around the world think it’s really important to modernize their core systems to meet what customers expect and to stay competitive. This is shown in market trends too. For example, the core banking software market was worth $10.89 billion in 2022 and is expected to grow at about 9.3% each year from 2023 to 2030.

Banks aren’t just looking to update their technology. They want to completely change how they operate to fit into a world where digital comes first. This change isn’t just because of new technology. It’s a strategic move to take advantage of new market chances, make customers happier, and meet strict rules in a global financial world that’s more connected than ever.

So, let’s explore the significance of updating core banking systems in 2024. We will examine the optimal timing for implementing these upgrades and discuss strategies for effectively planning and developing a new core banking infrastructure.

The push to update core banking systems in 2024 comes from several important factors: advances in technology, what customers want, competition, and rules and regulations. Each of these highlights why it’s so crucial for banks to change and get creative. Let’s look at each reason in more detail.

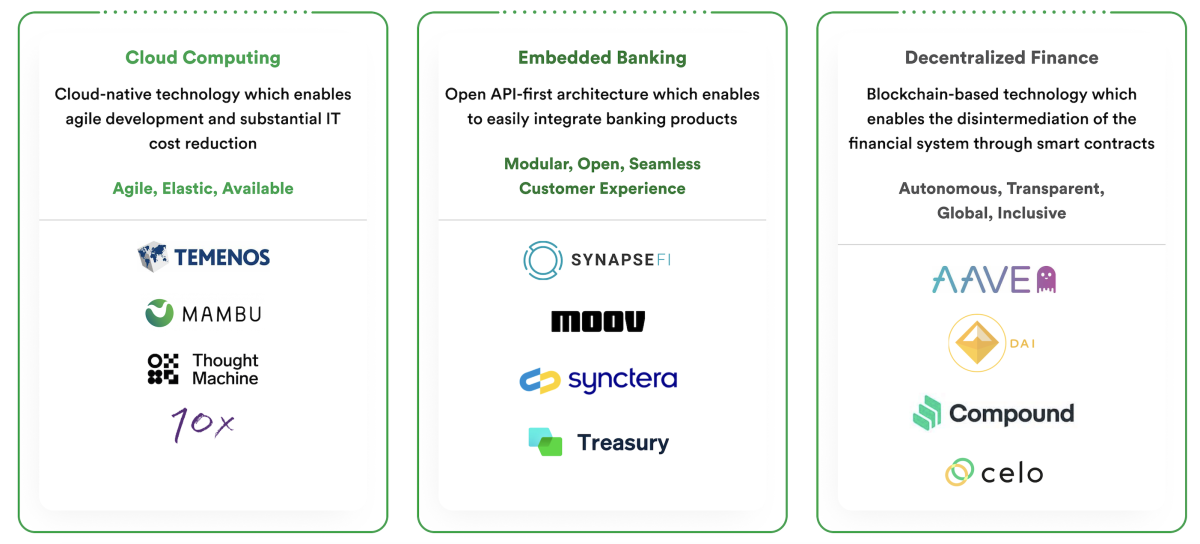

Recently, there’s been a big change in how technology is used in finance. The use of cloud computing, artificial intelligence, and application programming interfaces (APIs) has really changed what people expect from core banking systems. Using cloud technology in banking makes it easier to scale up or down, more flexible, and cuts down on costs. Banks that use a cloud-first approach can recover from disasters better and find it easier to follow rules, which is super important nowadays.

AI is now doing more than just powering chatbots. Insider Intelligence says AI saved the banking industry about $447 billion up until 2023. AI helps banks understand risks better, spot fraud, and give customers a more tailored experience. Banks using AI can analyze huge amounts of data to make smarter decisions and come up with new, innovative products.

Open banking, made possible by APIs, has really changed things. The global open banking market is expected to reach $43.15 billion by 2026. APIs let banks easily add third-party services, which leads to more innovation and a wider range of services. This is key to giving customers a more complete and integrated experience.

Digital banking has become a must-have, not just a nice-to-have. A McKinsey & Company survey found that since the pandemic, digital banking use has gone up by 20%. Customers now expect to be able to bank anytime, anywhere, get personalized services, and have a smooth digital experience. Old systems, which aren’t very flexible or easy to customize, make it hard for banks to meet these new needs and could lead to losing customers.

The growth of fintech companies and new types of banks (neobanks) is a big challenge for traditional banks. These new players use modern tech to offer customer-focused products and services. For example, the neobanking market is expected to reach $333.4 billion by 2026. Traditional banks need to update their systems to stay in the game and keep their customers in the face of these new competitors.

Following rules and regulations is still a big challenge for banks. The rules keep changing, and there’s more focus on being transparent, protecting data, and cybersecurity. Modern banking systems are better at keeping up with these changes, making sure banks follow the rules and avoiding expensive fines. For instance, with the introduction of GDPR in the EU, banks had to change how they handle customer data, which is easier with modern, compliant systems.

Financial institutions must pick the right time to update their core banking systems. This decision depends on factors like the state of old systems, chances for business growth, and how well it fits with the strategic vision.

The issues with old systems show it’s time for an update. These systems, once fine for simpler banking, now struggle with today’s complex and high-volume transactions. Banks face slow system responses, delays in processing, and even outages during busy times. Integration problems also pop up because these old systems can’t easily connect with modern digital platforms and fintech services.

High maintenance costs are another issue. These systems need special skills to manage and often break down, needing custom fixes. This leads to financial costs and the missed opportunity to adopt new technologies faster. These old systems can cause data to be stuck in silos, making it hard to see a complete picture of customer information. This limits data management and analysis, affecting strategic decision-making, personalized customer service, and operational reporting.

Security risks are a major worry too. Older systems weren’t built for today’s complex cyber threats, putting sensitive financial data at risk of breaches and cyber-attacks. This can compromise customer data and lead to non-compliance with evolving data protection laws.

We at rinf.tech helped a global banking and fintech leader modernize their old system. They had fragmented legacy applications that complicated managing customers and processes. This project included developing a custom monitoring and reporting application, automating banking workflows, and adding a modern business process layer.

This led to better system performance, more transparent processes, improved customer service, and a 6-digit figure in yearly cost savings.

On top of that, the customer managed to reduce effort spent on platform monitoring and cross-systems health checks by more than 35%.

Several signs show it’s time to update core banking systems for business growth. If a bank’s customer base, especially digital users, is growing, old systems might not handle the increased load well. Modern systems can manage this better.

When banks launch new financial products and services, old systems often can’t integrate them well, showing the need for more adaptable and fast development frameworks in modern banking. Expanding into new markets also brings challenges, like meeting different regulatory and customer needs. Modern core banking systems, built with global standards, offer the flexibility to meet these diverse requirements.

Aligning system modernization with a bank’s digital transformation goals is crucial. Modern core banking systems support this by enhancing digital interactions, enabling real-time data processing, and automating internal processes. This modernization is key for banks wanting to lead in innovation and customer-focused services, helping them compete with fintech companies and new types of banks (neobanks).

These modern systems also align with goals for operational efficiency by streamlining processes and improving decision-making through better data management. They’re vital for risk management and compliance, built to adapt to changing financial regulations and enhance risk monitoring and management.

In 2024, it’s essential for banks to adopt a cloud-first strategy when developing their core banking systems. Cloud technology brings huge benefits like scalability, flexibility, and cost savings, making it perfect for modern banking needs. Banks can use cloud services to adjust their resources as needed, which helps use resources efficiently and cuts down on infrastructure costs.

Cloud environments also make it easier for banks to innovate. They can quickly try out new apps and services. Plus, cloud services improve disaster recovery with better data redundancy and resilience. However, banks need to be careful about security and compliance when using cloud solutions, making sure they meet industry standards and regulations.

Implementing a new core banking system in stages is a smart move. It minimizes operational disruptions and makes the transition smoother. This approach breaks the modernization process into manageable parts, focusing on specific parts of the system at each stage.

By doing this, banks can move their operations from the old system to the new one gradually, reducing the risk of major failures or customer service issues. Phased implementation also allows for regular checks and adjustments, making sure each step meets overall goals and tackles any problems. This step-by-step process helps banks learn and adapt, leading to a more successful update.

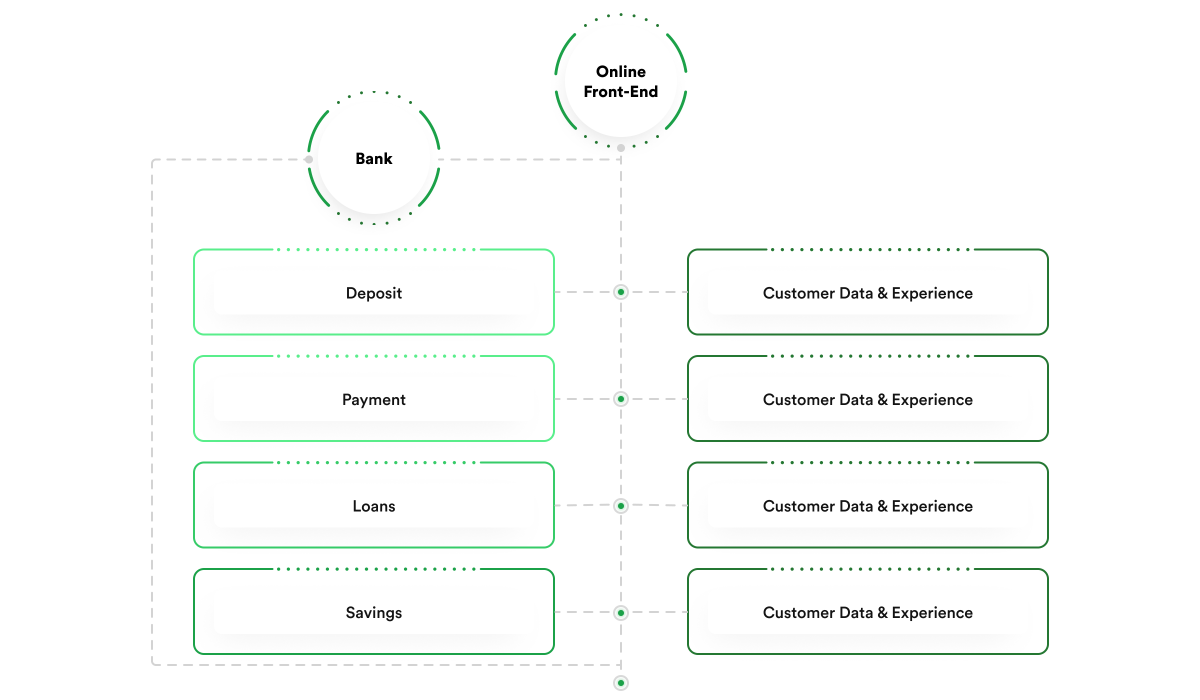

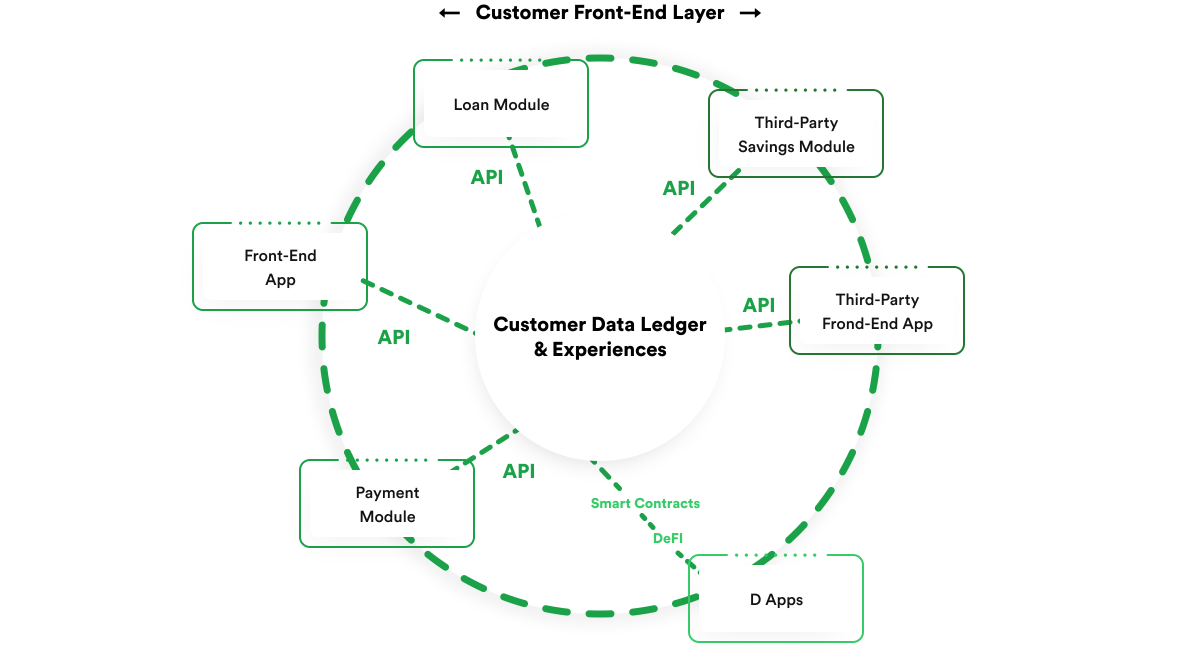

Having a core banking system that can easily integrate with other services and is open to new developments is crucial. Modern banking is all about being connected, involving various third-party services and apps. A system that supports APIs and microservices is key to creating a flexible and scalable system. APIs make it easy to integrate with external services like payment gateways, financial tools, and customer management systems, which improves the bank’s services.

Microservices architecture lets banks develop and deploy services separately, which makes the system more resilient and allows for quicker updates or changes. This approach also supports agile development, letting banks quickly respond to market needs or tech advancements.

Security and compliance are extremely important in developing core banking systems, especially with the rise in cyber threats and strict regulations. Banks need to make sure their new systems have strong security measures like advanced encryption, access controls, and continuous monitoring to protect against cyber threats and data breaches.

Complying with regulations like GDPR, PSD2, or local banking laws is also essential. Modern systems should be designed to easily adapt to changes in the regulatory landscape, including features for easy updates and modifications to meet new rules. Regular security audits and compliance checks should be a regular part of system maintenance, ensuring ongoing protection and adherence to regulatory standards.

The financial services industry is changing fast, driven by new technology, what customers want, competition, and rules from regulators. Moving from old systems to new, flexible, and efficient core banking platforms is not just a reaction to these changes but a strategic step to prepare financial institutions for the future.

However, updating core banking systems needs careful planning, smart execution, and expert advice. This is where having a technology integration partner becomes very important. A partner like this brings valuable knowledge to help navigate the complexities of modernization, making sure the transition from old systems goes smoothly and that the new system aligns with the bank’s strategic goals.

Our best advice is this: To stay relevant, competitive, and efficient in today’s ever-changing digital world, modernizing the core banking system is not just an option but a must. Working with a technology expert can lead to a successful change, allowing banks to fully use modern banking tech and establish themselves as innovative, customer-focused financial institutions.

Looking ahead, the decision to update core banking systems will be key to the success and durability of financial institutions in this digital era. The time to act is now, and the way forward is clear.

Exploring the immense potential of data-driven innovation within the financial services industry.

A comprehensive overview of how fintech innovations drive significant changes in the retail industry.

Examining AI’s diverse effects on finance, delving into its advantages and obstacles, aiming to understand its transformative influence and future impact on the sector.

Copyright © 2023 rinf.tech. All Rights Reserved.

Terms & Conditions. Cookie Policy. Privacy Policy.

Politica Avertizari de Integritate (RO)