Unleashing the Power of Data: The API Economy and Open Banking

Exploring the immense potential of data-driven innovation within the financial services industry.

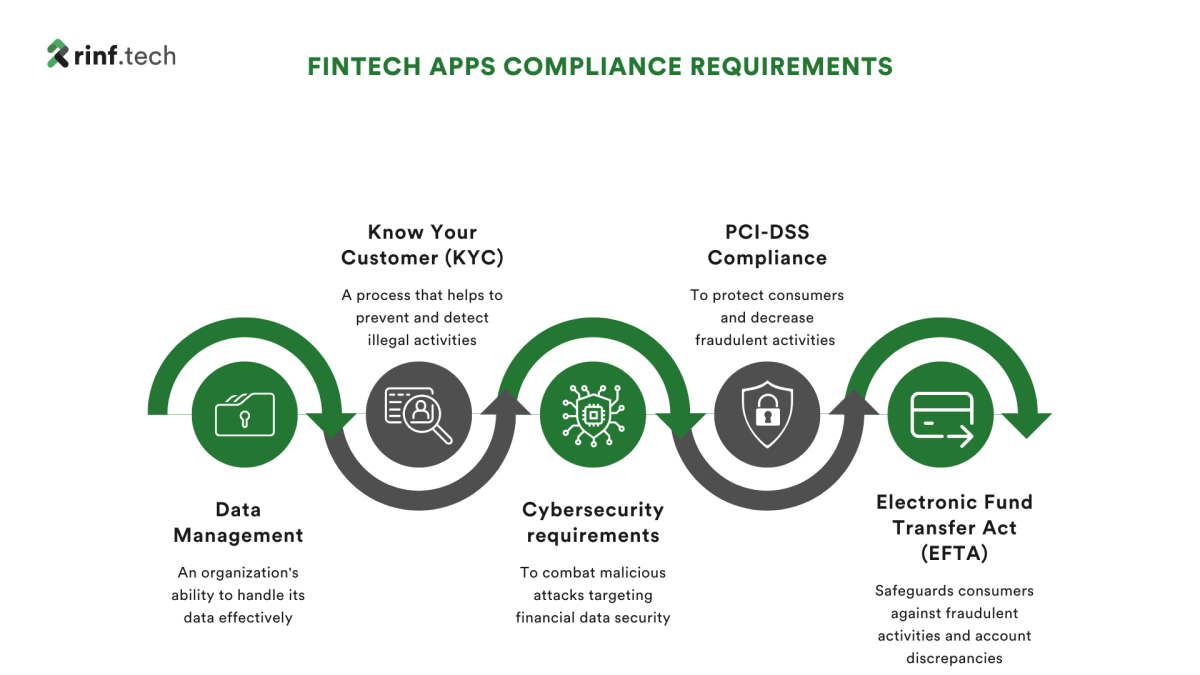

When developing Fintech mobile applications, financial transactions and data storage are critical components that require adherence to multiple regulatory measures. Regulations compliance is crucial for the success of your Fintech app. Not only does it help avoid penalties and sanctions, but it also enhances the safety of your financial app.

Ensuring compliance with regulations is essential in fostering user trust, resulting in an overall better user experience and, ultimately, app success.

Therefore, it is advisable to view compliance as a key to success rather than just another item to check off a to-do list.

This article analyzes the most crucial rules to follow when developing an application for the banking and finance industry.

To understand the current Fintech compliance and certification landscape, it is essential first to examine its origin and objectives. Fintech compliance involves adhering to regulations that govern innovative business models and financial technology, and aim to safeguard the interests of customers and investors’ capital.

The regulatory guidelines and certification for Fintech apps aim to mitigate three primary risks: data breaches, money laundering, and cyber-attacks.

Risk assessment and prevention of data breaches are crucial components of developing financial technology. Regulatory organizations can track down the perpetrators of data leaks, and noncompliance with anti-data-leak regulations can result in significant penalties, ranging from two to four percent of a company’s sales in European Union countries.

To combat the significant losses caused by money laundering, all countries have anti-money laundering (AML) policies in place, and there are regulatory agencies that coordinate operations and data.

Fintech and traditional banks are popular targets for cybercriminals, making cybersecurity regulations essential for protecting consumers’ interests.

Over 200 countries around the world have enacted Fintech-related laws focused on safeguarding data privacy and protection, according to the World Bank’s database. The EU’s General Data Protection Regulation (GDPR) is a widely recognized law protecting data privacy.

Data management refers to an organization’s ability to handle its data effectively. This involves several duties to guarantee that data is easily accessible, applicable, and trustworthy. Data management is primarily concerned with ensuring security and privacy in the context of fintech applications. The financial sector around the globe is very regulated in these two areas.

If you build a Fintech app for a particular jurisdiction, you must ensure data management compliance with local data protection legislation such as

Banks implement KYC (Know Your Customer) procedures to verify the authenticity of their clients and assess any associated risks. These processes help to prevent and detect illegal activities such as money laundering and terrorism financing. KYC procedures involve verifications such as ID cards, faces, documents, and biometrics. Banks must comply with KYC regulations and anti-money laundering policies to minimize fraudulent activities. The responsibility for ensuring KYC compliance lies with the banks.

To operate in the financial services sector, any company must adhere to the Know Your Customer (KYC) regulation, which applies to most banks and financial service providers, including lenders and insurance companies.

To comply with the anti-money laundering (AML) laws, the KYC requirements differ for each region and must be satisfied. In the United States, the Banking Secrecy Act (BSA) and the US Patriot Act are the governing bodies of KYC, with the latter playing a slightly more minor role.

In today’s world, the Financial Services sector is a top target for malicious actions, requiring organizations to guard against various attacks, including insider threats, social engineering, and sophisticated, targeted operations by Advanced Persistent Threats (APTs). As these organizations implement new technologies, operational strategies, and data-sharing practices, it is unsurprising that cyber risk has increased for them in recent years.

A Forbes report reveals that cybercrime causes damages worth $2.9 million per minute worldwide. Thankfully, numerous technologies are being developed to mitigate and combat such malicious attacks, particularly those targeting financial data security.

Fintech organizations are particularly vulnerable due to the absence of strict cybersecurity regulations, making them a prime target for hackers.

Several financial systems have been subjected to various attacks, with some breaches originating from third-party providers instead of the fintech app itself. This highlights the need for a comprehensive cybersecurity approach covering the entire ecosystem, including servers and network endpoints. Employing the seven-level cybersecurity model is an excellent way to accomplish this objective.

The PCI DSS is the universal security benchmark for any organization that holds, handles or transfers cardholder and sensitive authentication data—establishing a minimum level of safeguarding measures aids in protecting consumers and decreasing fraudulent activities and data breaches throughout the payment network. It applies to all institutions that accept or process payment cards.

Failure to adhere to PCI-DSS regulations can lead to significant penalties the credit card processor imposes. It is essential to acknowledge that noncompliance alone can have repercussions without the occurrence of a data breach.

The Electronic Fund Transfer Act, commonly known as Regulation E or Reg E, is a federal legislation that safeguards consumers against fraudulent activities and account discrepancies. Though it covers the majority of transactions, certain exceptions exist.

In 1978, the EFTA was introduced to address the rising trend of electronic payment methods replacing physical checks. It safeguards electronic transactions such as online transfers and debit card payments by allowing consumers to dispute transactions and defining the consumer’s liability for unauthorized transactions.

To adhere to EFTA regulations, users must provide specific details regarding their fund transfer transactions. It outlines the consequences of unauthorized transactions and the protocol to follow in case of discrepancies.

It is essential to validate the feasibility of your Fintech idea before starting the development of an application. This can be accomplished through a product discovery stage, which is necessary to evaluate the project’s complexity, estimate total costs, and analyze potential risks. It also helps determine the viability of the product idea. This stage helps you and your Fintech app development team prepare for a timely and hassle-free product release while ensuring all stakeholders are on the same page.

It would be best to choose which fintech industry you will focus on first when starting a finance app (digital banking, insurance, loan lending, etc.), as each niche has specific Fintech requirements that must be met. Additionally, there are various regulatory requirements and certificates for the operation of Fintech applications in every nation, even state.

A Fintech app is an integral part of a broader ecosystem encompassing banks and other fintech platforms. The interconnectedness of these systems leads to a continuous flow of sensitive data, which hackers can readily intercept unless robust infrastructure protection is in place.

As a result, basic security measures need to be improved to guarantee a secure user experience. It is essential to contemplate improving the overall security of your fintech app infrastructure. Adopting the seven levels of cybersecurity is one of the most reliable approaches to achieving this. This method operates like a medieval castle, each layer providing a defensive mechanism.

For financial applications, authentication, and access control are crucial entry points. As a result, it is not advised for developers of fintech apps to depend exclusively on a username and password to authenticate users. To guarantee a secure user experience, alternative industry-standard authorization methods like biometrics and two-factor authentication (2FA) should be used.

A sophisticated security measure called biometric authentication uses distinctive biological characteristics like fingerprints, iris scans, and facial recognition to confirm users’ identities. The user must enter two separate forms of identification, such as a password and a verification code sent to their mobile device, to access the app when using 2FA, on the other hand.

By lowering the possibility of unauthorized entry and possible data breaches, these more advanced authorization techniques improve the general security of financial applications. Fintech app developers can encourage trust and confidence among their user base by implementing such measures, which will eventually help promote their apps’ growth and success.

Data encryption is one of the best and most dependable ways to protect user information, making it an essential part of the security plan for any financial software. To ensure that only people with the proper permissions can access the original data, encryption entails transforming plain data into ciphertext using an algorithm.

Surprisingly, so many people don’t give encryption the attention it deserves despite its crucial significance. Data must be encrypted before being stored in a database, and the Advanced Encryption Standard is one of the best encryption methods currently accessible. (AES). AES is widely used by financial institutions around the globe and is regarded as the industry standard for storage encryption.

Data security is ensured by implementing encryption using AES or other robust encryption techniques, even in the case of a data breach. Additionally, it fosters user confidence, which aids in the expansion and success of financial apps. Therefore, to improve the general security of their apps and protect user data, fintech app developers should prioritize data encryption in their security strategy.

We at Rinf.tech have extensive expertise in engineering and integrating cutting-edge technology and business solutions for the complex and rapidly evolving world of finance.

Our partners collaborate with us to develop custom solutions that meet their unique needs, from eBanking applications to legacy apps modernization and optimization to complex banking process automation.

We prioritize quality, security, and cost-effectiveness in our custom solutions, ensuring that Fintech companies can thrive in the new digital landscape and prepare for the future.

Exploring the immense potential of data-driven innovation within the financial services industry.

A comprehensive overview of how fintech innovations drive significant changes in the retail industry.

Examining AI’s diverse effects on finance, delving into its advantages and obstacles, aiming to understand its transformative influence and future impact on the sector.