8 Tips For Building Highly Secure and Compliant Fintech Solutions

Based on the rinf.tech extensive experience with custom Fintech development and the latest market research.

Based on the rinf.tech extensive experience with custom Fintech development and the latest market research.

Fintechs need to understand their customers’ needs and the corresponding rules and regulations of each country where the solution operates. These may be data privacy, security compliance or a combination of both. The key is to align your solution with these guidelines to ensure fintech application security and avoid regulatory fines and reputational losses.

To achieve this alignment, it’s recommended that you hire or appoint a lead security consultant who’ll work alongside your product development team to ensure the right compliance standards and controls are in place.

Yet, outsourcing your fintech solution development project to a specialist provider with deep domain knowledge and an excellent understanding of the fintech compliance ecosystem eliminates the need to hire a consultant. Software consultancies specialized in Fintech solutions typically cover all bases on their own. They have software engineers with tribal Fintech knowledge and access to the newest technologies and methodologies to deliver a solution that will tick all security boxes.

Approximately 75% of high-level threats detected could have been avoided with proper application protection.

Security Boulevard Tweet

One of the most common and significant risks for fintech applications is being targeted by hacks and cyberattacks.

Of course, this should come as no surprise. Fintech is a particularly attractive target for hackers and frauds because it deals with people’s money and sensitive financial data such as bank accounts and social security numbers.

A recent survey conducted by Contrast Security has revealed that over the past year, a range of cyberattacks have affected more than 60% of global financial institutions that have assets worth at least $5 billion. The incidents include attempts to obliterate data held by these institutions, often with the aim of erasing evidence after a counter-incident response by the victim, as well as “watering hole” attacks where cybercriminals hijack and trap a website or mobile app used by e-finance customers. In addition, 64% of these institutions reported a rise in attacks that exploit vulnerabilities in apps.

Estimates from Statista’s Cybersecurity Outlook show that the global cost of cybercrime is expected to surge in the next five years – rising from $8.44 trillion in 2022 to $23.84 trillion by 2027.

According to Security Boulevard, every Fintech application they tested had at least one security flaw: 84% of Android and 70% of iOS apps contain one critical or high vulnerability.

Now let’s take a look at some of the most dangerous cyber threats targeting fintech solutions today.

Although Fintech apps are subject to all kinds of cyberattacks, two of them stand out as the most popular among hackers – ransomware and social engineering.

Ransomware is a malware type that encrypts sensitive files or blocks enterprises from accessing their systems and data. The only way to unlock it is to use a mathematical key that only the attacker knows, which you will receive after paying the ransom (hence the name).

A recent Atlas VPN report once again demonstrated the severity of the threat. The company found that ransomware attacks increased 151% in the first half of 2021 compared to the first half of 2020, with the United States facing more ransomware threats than any other country.

However, in 2022, there was a 23% decline in the number of ransomware attacks, suggesting that the increased attention and monitoring by governments, as well as the heightened awareness of the risks, are making an impact.

The silver lining is that a ransomware attack usually doesn’t steal or otherwise compromise user data. However, this still leads to costly service disruptions or data recovery.

Nowadays, hackers tend to ditch sophisticated attacks in favor of something much less sophisticated, but just as effective – exploiting human weaknesses.

These shenanigans are called social engineering.

Phishing is the most popular social engineering attack, accounting for over 30% of all data breaches. It involves manipulating users to divulge passwords or give administrator access to attackers using various methods, from email to fake phone calls.

According to the FBI, phishing was the most widespread type of cybercrime in 2020, and the frequency of phishing incidents nearly doubled, from 114,702 incidents in 2019 to 241,324 incidents in 2020.

The FBI said the number of phishing complaints in 2020 was more than 11 times the number in 2016.

According to Verizon’s 2021 Data Breach Investigation Report (DBIR), phishing is the main “activity” seen in hacks over the past year, and 43% of hacks involve phishing and/or pretext.

Fraud and money laundering have always been serious risks when it comes to the finance industry. But with Fintech, these risks are amplified.

Fintech is a double-edged sword. While this improves consumer access to financial services, it also allows fraudsters to commit financial crimes.

For example, let’s look at money laundering as one of the most common financial crimes that government agencies always monitor.

The most important part here is the first step – placement.

The criminals take large amounts of dirty money (profits from criminal activity or corruption) and distribute it among several bank accounts and financial institutions. Smaller deposits give the impression that they are routine legitimate transactions for the authorities.

Opening multiple bank accounts used to be a problem for money launderers because banks usually had strict requirements. But not so with Fintech. Digital banks are making this process easier than ever, which means that criminals can open as many accounts as they like.

With the anonymity and ease of cross-border transactions, transferring money to a country with weaker financial regulations and anti-money laundering (AML) control is now effortless.

Unfortunately, while money laundering isn’t necessarily your fault, it can still damage your Fintech app. This diminishes consumer confidence and can lead to authorities imposing fines on you or even blocking you for non-compliance.

Perhaps the best example of Fintech scam failure is Wirecard.

In 2020, a payment processing company collapsed after its CEO and other executives took over $4 billion in a multi-year money laundering scheme.

The average cost of a data breach is estimated at $4.24 million in 2021 - the highest in 17 years.

IBM Tweet

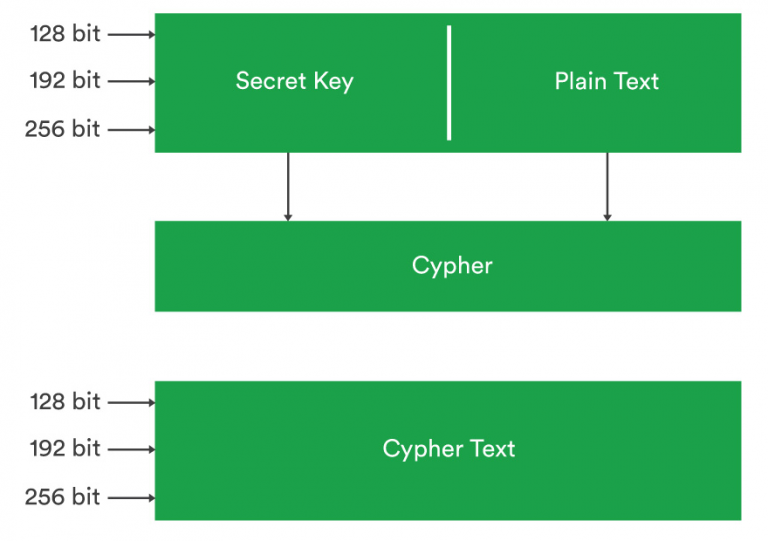

Encryption should be the top priority of any Fintech application. Otherwise, you will be much more vulnerable to these risks.

People will use any Fintech app based on the confidence that their data is in your hands, which is why data leaks damage your reputation.

Besides establishing trust, encryption is also one of the easiest ways to comply with most government regulations.

For example, the Payment Card Industry Data Security Standards (PCI DSS) require companies to encrypt credit card information before storing it in their database.

While neither the Gram-Leach-Bliley Act (GLBA) in the US nor the General Data Protection Regulation (GDPR) in the EU requires encryption, they strongly recommend it for compliance.

So, how do you build highly secure and compliant FinTech applications? Let’s look at the top eight FinTech application development tips below.

Gramm-Leach Bliley Act (GLBA) & Fair Credit Reporting Act (FCRA) guidelines fall under FTC.

Applies to anyone storing data of EU citizens.

Applies to anyone offering cross-border money transfers.

Applies to anyone offering digital payment transactions.

Applies to organizations that handle branded credit cards from the major card schemes.

Applies to anyone offering regulated financial services and credits.

Penetration testing (aka pen testing) is a simulated attack by a hacker. In web application security, penetration testing is commonly used to extend the web application firewall (WAF).

Penetration testing can involve attempts to break into any number of application systems (e.g. application protocol interfaces (APIs), front-end/back-end servers) to identify vulnerabilities such as unsanitized inputs that are susceptible to code injection attacks.

The information obtained from the penetration test can be used to fine-tune WAF security policies and fix discovered vulnerabilities.

The first stage includes:

The next step is to understand how the target application will respond to various intrusion attempts. This is usually done with:

Static analysis – checking the application code to assess its behavior during operation. These tools can scan all the code in one pass.

Dynamic analysis – checking the application code in working order. This is a more practical way to scan because it gives you real-time insight into the performance of your application.

This phase uses web application attacks such as cross-site scripting, SQL injection, and backdoors to discover target vulnerabilities. Testers then try to exploit these vulnerabilities, usually through privilege escalation, data theft, traffic eavesdropping, etc., to understand the damage they can cause.

This phase aims to see if a vulnerability can be exploited to ensure a permanent presence on an exploited system – long enough for an attacker to gain comprehensive access. The idea is to simulate complex persistent threats that often remain on the system for months in order to steal the organization’s most sensitive data.

The penetration test results are then combined into a detailed report that states:

This information is analyzed by security personnel to help tune enterprise WAF settings and other application security solutions to remediate vulnerabilities and protect against future attacks.

External penetration tests target company assets that are visible on the Internet, such as the web application itself, its website, and email and domain name servers (DNS). The goal is to access and extract valuable data.

In an internal test, a tester who has access to an application behind his firewall simulates an attacker. This is not necessarily an imitation of a fraudster. A typical startup scenario could be an employee whose credentials were stolen due to a phishing attack.

In a blind test, only the name of the target enterprise is given to the tester. This gives security personnel the ability to see how the actual attack on the application will occur in real time.

In a double-blind test, security personnel have no prior knowledge of a simulated attack. As in the real world, they will not have time to strengthen their defences before attempting a breakout.

In this scenario, both the tester and security personnel work together and keep each other informed of their movements. This valuable training exercise allows the security team to receive real-time feedback from the hacker’s perspective.

FinTech solutions need to use code obfuscation. This approach helps secure your application from malicious cloning campaigns. In this scenario, financial application clones will look to gather sensitive PII through cloning.

Software cloning is a popular technique used by hackers to trick the user into sharing their sensitive data. But whenever you use code obfuscation, it makes analyzing the app’s source code a significant challenge. In fact, it’s impossible to understand how the algorithms work, thwarting attempts to reverse engineer a FinTech app.

Regardless of your business vertical, building secure and compliant solutions is critical to business relevance. As such, enterprises must follow security best practices every step of the way.

As a Fintech app provider, it is your responsibility to protect your clients from financial crime and prevent it in the first place.

Know Your Customer (KYC) initiatives are crucial for the fight against money laundering. The goal is to make sure that customers are who they are and not a pseudonym for someone with a criminal record.

KYC is a mandatory verification process that each client signing up for your fintech solution will have to undergo for money laundering and security breech prevention. The verification repeats with regular intervals after that. This is often due to the fact that the account holder presents government identification cards, photographs, and other legal documents used to identify them.

However, scammers are becoming more sophisticated, cheating KYC using fake IDs and even wax figures to create deepfake photos and pass verification.

One way to get around it is to leverage survivability detection technologies.

For example, you can ask people to perform random actions or show the current date in a live video to authenticate them.

But KYC is just the beginning. Using AI for continuous monitoring of user behavior is critical.

AI solutions can help you detect unusually high costs, resetting multiple passwords, address change requests, and other suspicious activity related to fraud or hacking.

Integrity and completeness is another important data issue. In other words, how do you know the data you have is reliable?

Anything from corruption to deletion can happen to data during storage or transfer. Unfortunately, this can lead to inaccuracies and errors that can be fatal to the financial sector.

Can you imagine a catastrophe when even one zero is missing on the balance of a client’s bank account?

Ensuring the integrity and completeness of your data is all about doing due diligence. In particular, your system should alert you if the data is incomplete or comes in an unexpected format. This allows you to detect and fix the problem early.

Having a single consistent format also helps make data comparison and management much easier.

Finally, a good reconciliation process is needed to identify discrepancies by comparing them with an independent source.

As you can see, creating a Fintech application is not an easy and risky task. When not properly addressed, you can face a range of financial and regulatory challenges.

Being aware of these risks gives you an edge over many other Fintech app developers because you already know what you’re running into.

Now all you need is a reliable crew to help you navigate this unchartered water safely.

At rinf.tech, we’ve been helping finance and banking companies, both startups and world-famous established brands, design, develop, and deploy highly secure and compliant scalable applications since the advent of Fintech. Our outcome-based approach has helped our partners ensure uptime, deliver enhanced user experiences, and (most importantly) avoid security breaches.

Embedding security early and throughout the lifecycle of FinTech solutions is vital to strengthening and maintaining your security posture. It’ll also help nurture a culture of cybersecurity throughout the organization.

Get in touch with our in-house security specialists to find out how we can help better secure your next FinTech project!